Posted on March 02, 2022

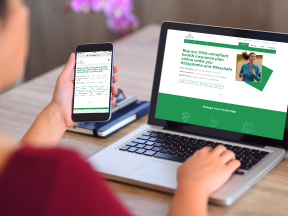

Oman Insurance, one of the leading insurance providers in the UAE, has joined hands with Aster DM Healthcare, the largest network of integrated healthcare provider in GCC and India, to offer exclusive and comprehensive health insurance plans for corporates and individuals in UAE. With years of expertise in medical insurance, OIC will offer the four exclusive plans starting from 1st March, 2022.

Many employers, during the Covid-19 pandemic, have recognized the importance of relooking at their group health insurances in order to secure the future of their employees in the face of unforeseen circumstances and provide a comprehensive coverage. In the UAE, as it is mandatory for all residents to have health insurance, it becomes important for insurance providers to offer a comprehensive and affordable coverage plan for all their customers. Aster’s trusted brand name and geographical spread across UAE and Oman Insurance’s seamless service will benefit the end users of the insurance with easy access to Aster’s health facilities.

Commenting on the partnership, Ms. Alisha Moopen, Deputy Managing Director, Aster DM Healthcare said, “Over the years we have seen so many instances where people purchase health insurance policies for themselves and their families with the expectation of availing the much-needed care from their trusted doctors and soon realise that their access is restricted by other parties which leads to disruption of care. This exclusive partnership between a payer and a provider will break down these barriers and ensure that any patient availing this plan receives seamless quality care, right when they need it without hassles. This is a one of its kind partnership in the region which will set a new benchmark in accessing quality healthcare with ease.”

“With both the expertise of Aster and Oman Insurance teams, we have co-developed 4 types of medical policies covering the needs of our customers. We strongly believe that, with the mix of an extensive network, affordable pricing and state-of-the-art servicing, Aster and Oman Insurance are not only innovating on the market but are also creating an unique alternative to existing medical coverages.” said Jean-Louis Laurent Josi, Chief Executive Officer, Oman Insurance Company.

The premiums being offered to the customer enlists a range of offerings based on various benefits such as co-pay, pharmacy benefits, specialist access, Aster’s network of clinics & hospitals, etc. Specific list of aster clinics and hospitals will vary for each plan based on premium.