Posted on August 24, 2019

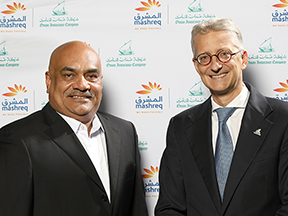

Oman Insurance Company and Generali Global Pension, a part of Generali Group, have joined hands to offer GO Saver, a group savings and retirement insurance plan specific to the unique needs of UAE companies. The plan aims at supporting employers to manage their End of Service Gratuity (EoSG) liability with 100% capital protection option.

GO Saver is a fully integrated solution for employers and their employees with investment choices, contribution flexibility, online access to investment portfolio and more. The plan also offers portability that allows members to carry their plan when they move to another country and opt to receive their proceeds in their new country of residence.

Commenting on the occasion, Jean-Louis Laurent Josi, CEO of Oman Insurance said, ”We have worked very closely with the Generali team to develop a unique proposition which gives employers an option to manage their End of Service Gratuity liability with a funded workplace savings insurance plan. Our collaboration addresses a real growing need in the region for a solution that is secured yet evolves with the employee savings needs and employer retention objectives..”

The plan ensures easy voluntary contributions by offering flexible payment methods, complimentary switches, profit booking, withdrawal and top ups.

Anne De Lanversin, CEO of Generali Global Pensions said, ”Through this partnership, we as reinsurer and pension specialist, present Generali’s best global solutions and expertise to the UAE, combined with the Oman Insurance’s deep knowledge of local market. This win-win proposition for everyone provides a capital protected solution along with access to a wide array of global and local investment solutions. I am confident of the quality and value GO Saver offers to our clients in the UAE market.”

For more details about the product, please visit www.tameen.ae.