In an increasingly unpredictable and competitive global business environment, your corporate customers can suddenly find themselves unable to make payments for the merchandise shipped or services rendered.

This, in turn, affects your cash flow and then your ongoing operations.

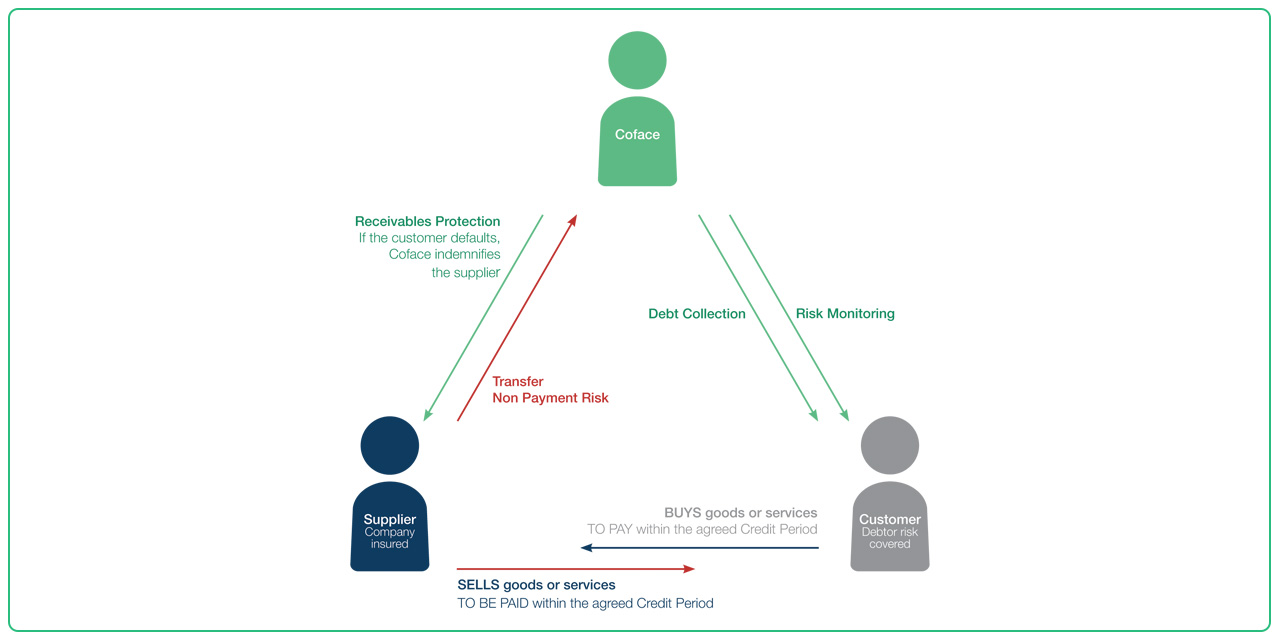

Credit Insurance is a good way to protect your company and your cash flow by transferring the risk of credit defaults to an insurer. It safeguards your ‘Account Receivables,’ which is your largest asset and future source revenue.

We have partnered with Coface, one of the leading global credit insurance partners in the industry, to give you the best trade credit insurance solutions in the market. We offer cover for both domestic and export trade transactions.

Our Trade Credit Insurance policy strategically combines the three core elements of credit management: Information, Protection and Collection. We support you through your trade cycle by providing you information on your potential customers, protecting your outstanding receivables during sales transactions and eventually taking over your debt, if the invoices remain unpaid.

-

Access to New Financing Opportunities

By insuring your receivables, you can get improved borrowing terms and increased credit facilities from our partnering banks. -

Increased Revenue

Improve sales by increasing credit lines of existing customers, and gain new customers by offering credit payment from day one. -

Know Your Customers Better

You get access to our database of 65 million monitored companies, to track your buyer’s past payment behaviour. -

Protect Your Receivables Against Payment Default

The primary benefit of the product - to take over the trade credit risk of your open account sales, and so protect your receivables

-

Apply by Phone

Call us at 800 SUKOON (785666) for more information and to enrol over the phone.

-

Apply by Email

Drop us an email with all your details and we'll get back to you soon.

-

Apply in Person

Walk into one of our branches to get information, apply, and enrol in person.