When it comes to car insurance in the UAE, one size doesn't fit all. That's why we keep our auto insurance portfolio diverse by offering a range of car insurance plans. Whether you're a safety-conscious driver seeking peace of mind, a Tesla owner looking for exclusive tailor-made plans, or a luxury car owner who wants a privilege cover for their vehicle, we've got you and your car covered.

Check out our motor insurance plans below and choose the one that works best for you. Here, you have the option to buy car insurance online, get a quote, renew your existing policy, or make a claim in the unfortunate event of an accident.

-

See more details -

-

See more details

Having car insurance in the UAE is a legal requirement whether you drive in Dubai, Sharjah, or Abu Dhabi. As per RTA norms, at least a third-party car insurance policy is necessary for your car to be eligible for driving. While third-party liability insurance only covers the liability against a third party (person or property), a comprehensive insurance policy provides complete financial protection against accidents or losses caused to your vehicle as well as to third parties.

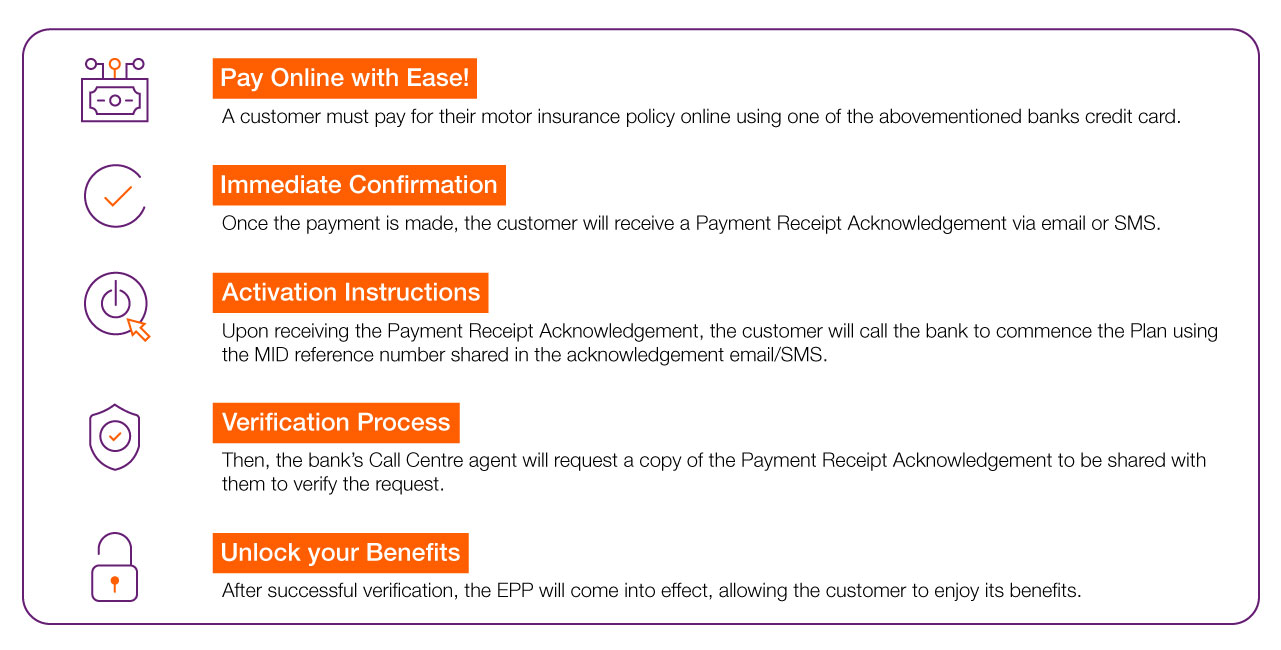

Now enjoy 100% coverage for your car, while you pay your insurance premium in monthly installments - that too at zero interest!

Yes, you heard it right. If you’re a member of one of the participating banks listed below, then you can pay in convenient monthly credit card installments.

Below is a summary of the participating banks and offers:

Plan Details

|

|

|

|

|

| Tenure | 3 or 6 months | 3 or 6 months | 3 or 6 months | 3 or 6 months |

| Minimum Premium (AED) | 500 | 1,000 | 1,000 | 1,000 |

| Processing Fee (AED by cardholder) | 0 | 50 | 49 | 0 |

| Interest accrued on EPP % | 0% | 0% | 0% | 0% |

-

50+

Years of Experience

-

500+

CLIENTS CHOOSE US DAILY

-

EASY

QUOTES AND CLAIMS

-

86%

CUSTOMER SATISFACTION

Downloads

FAQs

-

Yes absolutely, if you have opted for this benefit in your plan. This optional benefit is available only for private vehicles of non-commercial nature under comprehensive motor policy. -

Yes, we insure cars, vans, buses and a lot more. The rate usually depends on the age, the capacity, make and value of the vehicle. -

Yes, if your car is insured with us, your cover will extend into Oman. -

Under our motor insurance plans, we offer the following types of covers:

• Comprehensive cover, which covers any accidental damages to the owner’s vehicle and property damage, injury and death to any third party

• Fire & theft cover

• Third-party liability cover, which only covers any property damage, injury and death to third parties

• Extension for personal accident for drivers, family members and passengers. This extension is available for all covers -

Yes, of course! You can get your car insurance renewed and grab your motor insurance certificate from any of our branches near you. -

Yes, we will pay your claim as long as the vehicle was not on any safari activities at the time of the accident. -

If it is your fault, you will have to pay the excess amount as mentioned in your policy. But if it is not your fault, you don’t have to pay any excess. -

Yes, of course. Driving experience anywhere in the GCC counts towards your eligibility for insurance with us. -

You can contact our motor claims unit or our call centre through our toll-free number 800 SUKOON (785666). We will arrange towing facility for your car. -

Under our motor insurance plans, we offer the following types of covers:

• Comprehensive cover, which covers any accidental damages to the owner’s vehicle and property damage, injury and death to any third party

• Fire & theft cover

• Third-party liability cover, which only covers any property damage, injury and death to third parties

• Extension for personal accident for drivers, family members and passengers. This extension is available for all covers -

As a visitor, yes, he will be covered. However, for that, he should have a valid driving license and all relevant permissions from the local traffic department. -

No, you do not.

Contact us

-

Customer Service Contact Centre

-

Complaints

-

General enquiries

Reach us

-

Head Office

Sukoon Building

Omar Bin Al Khattab Street, Next to Al Ghurair Mall

Deira, P.O. Box 5209

Dubai, United Arab Emirates

-

For our other branch locations, please click here.