Posted on August 18, 2025

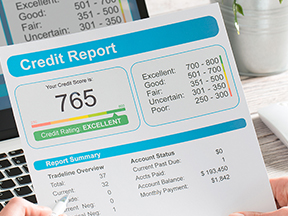

Sukoon Insurance PJSC, a leading insurer in the region, has acknowledged the recent Moody’s Ratings (Moody’s) report, which reaffirmed the company’s A2 Insurance Financial Strength Rating (IFSR) with a stable outlook. The ratings reflect Sukoon’s robust market position, diversified business profile, risk management capabilities, high quality reinsurance support, high quality liquid investment portfolio with strong capital adequacy.

The report highlights Sukoon’s focus and investment in customer service which is a key differentiator in a highly competitive market, especially for medical and consumer insurance. The report also acknowledged the company’s leading position in commercial insurance with a good reputation of technical underwriting expertise and its strength to manage profit volatility through international expansions and strong reinsurance partnerships.

Hammad Khan, Sukoon’s interim CEO and Chief Financial Officer commented, “We closed the first half of the year with a strong financial performance despite challenging market conditions. With insurance revenue reaching AED 3.1 billion and net profits increasing to AED 192 million, these outstanding results demonstrate our underwriting expertise, resilient business model, and most importantly the effectiveness of our team, guided by a clear vision from the board.”

Moody’s reported that the company’s expenditure control, steady investment income and underwriting profitability supported in achieving five-year average Return on Capital (ROC) of 9.5% and a combined ratio of 94.9% as of 2024. The report also mentioned that in contrast to the significant losses faced by the industry, Sukoon experienced minimal impact from the 2024 Dubai floods. The agency further cited that this highlights the effectiveness of Sukoon’s risk management capabilities and effective reinsurance protection. Moody’s expect that Sukoon’s profitability will continue to strengthen in line with its ongoing business and geographic diversification.